This is the first in a set of posts to highlight mortgage features that you could make use of:-

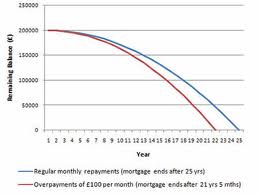

- Overpayments drive down the total amount and term you pay

1. Over-payments – most mortgage providers will allow you to overpay either monthly or by lump sum into your loan with no penalty, even if you are currently within your tie in period.

The limit for these is usually either 10% of the outstanding loan per year or a set amount per month e.g. Nationwide allow £500 per month, Halifax 10% of the balance per year. Check with your lender about their limit.

Some of the uses of overpaying can be to increase your equity following a downturn in value, repay fees added at the start or shorten the overall term of the loan. All 3 of these leave you in a stronger position when you next need to do something with your loan.

For people on Interest Only this can be a useful tool to start to pay down the mortgage especially if you do not/cannot make the commitment to full repayment at this point. Don’t let the problem build, my advice would be a full review, however consider overpayments as a way to tackle it at a rate you can afford via over-payments.

And remember that most lenders LOVE the fact they are getting their money back, however be aware that if it turns out you need the money back at some point then you will have to go through the further advance process, or book some ‘holiday’ months from your mortgage, if you lender offers this. Mortgage Over-payment is great, but don’t over-stretch yourself.

We have just added a Mortgage over-payment calculator to the site meaning you can now see what effect a small monthly addition to your mortgage can make.

Before clicking the link I want you to imagine how much extra you would need to pay monthly to clear your mortgage 3 years early.

Now go find out, it might be less than you think and remember if this is still not clear, why not give us a call on 0131 339 2281 and chat for free to a mortgage advisor.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your enticle helped me a lot, is there any more related content? Thanks!

discount androxal cost without insurance

get androxal low price

cheap enclomiphene cheap online no prescription

how to buy enclomiphene generic canadian

cheapest buy rifaximin price netherlands

rifaximin pills canada

buy xifaxan generic side effect

ordering xifaxan generic good

order staxyn uk pharmacy

buying staxyn generic pharmacy in canada

purchase avodart without rx online

how to order avodart purchase online from canada

dutasteride pills from canada

buy cheap dutasteride uk in store

get flexeril cyclobenzaprine online mastercard accepted

buying flexeril cyclobenzaprine generic cheapest

get gabapentin uk cheap purchase buy

overnight gabapentin ups cod

discount fildena australia generic online

purchase fildena cheap trusted

discount itraconazole generic london

itraconazole orders cod

jak dostat lékaře k předpisu kamagra

online konzultace pro kamagra

à faible coût kamagra en ligne

comment acheter kamagra en france

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.