In the world of financial transactions, especially when securing a mortgage, one’s credit file stands as a testament to their financial behaviour and trustworthiness. Yet, it’s a common misconception that only ‘perfect’ credit will pave the way for smooth mortgage approvals. Let’s shed some light on the matter.

Your credit file is a comprehensive record of your borrowing history. This details all your financial commitments, past repayments, and any outstanding debts. Mortgage lenders rely on this information to gauge your reliability as a borrower. However, what many individuals don’t realise is that very few people possess what can be considered a ‘perfect’ credit file. Life is full of unexpected twists, and sometimes events out of our control can leave a dent in our credit history.

Fortunately, mortgage lenders are well aware of this reality. They understand that not every missed payment or financial hiccup represents a risk. As such, there exists a spectrum of lenders, many of whom are more than willing to consider applicants whose credit histories are less than immaculate. They evaluate the broader pictur, so taking in your current financial stability and any blemishes on your credit file.

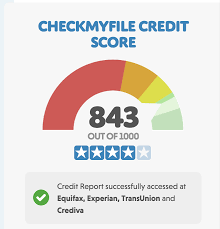

In light of this, it’s paramount to understand and regularly review your credit. Being well-informed empowers you to make the best decisions for your financial future and ensure you’re not left in the dark about where you stand.

Recommendation:

Before you embark on your mortgage journey, arm yourself with knowledge. Obtain a copy of your credit file and understand your financial standing.

For anyone without access to their file here is an offer of the 30 day free trial and £14.99 per month after that. You have the ability to cancel the trail or subscription at anytime. – Click here to access your credit report

If you download your file then we will very happy to give you mortgage advice based on this information. Please call 01313392281 or complete the below form.