With the average price of a home increasing consistently throughout the last few decades, first-time buyers are facing serious affordability challenges.

Indeed, This Is Money reports the average deposit needed by a first-time buyer now stands at £62,470. For young people at the beginning of their careers, it could be almost impossible to save this amount in the time frame they desire.

Keep reading to find out a key challenge facing first-time buyers today, plus two ways you can offer parental help.

House prices have continued rising sharply, whereas wages are somewhat stagnating

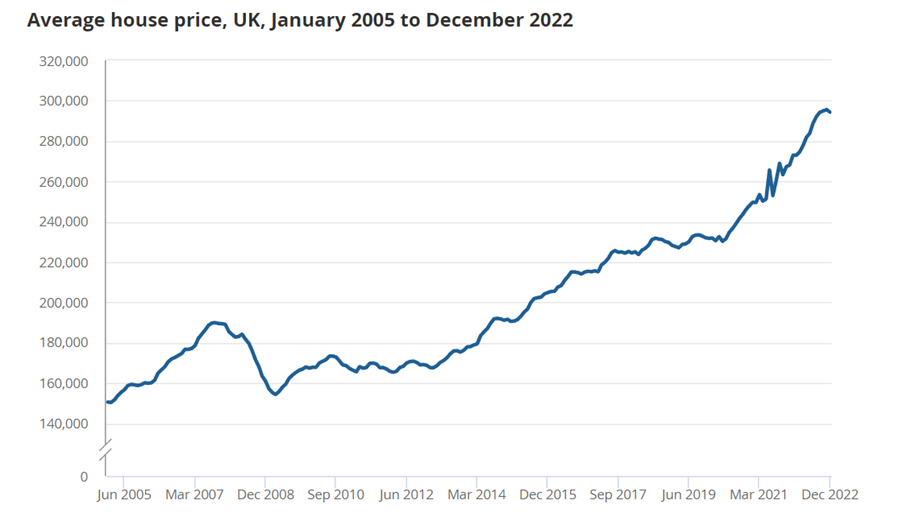

The below table from the Office for National Statistics (ONS) exemplifies the overall rise in UK house prices between January 2005 and December 2022.

Source: ONS

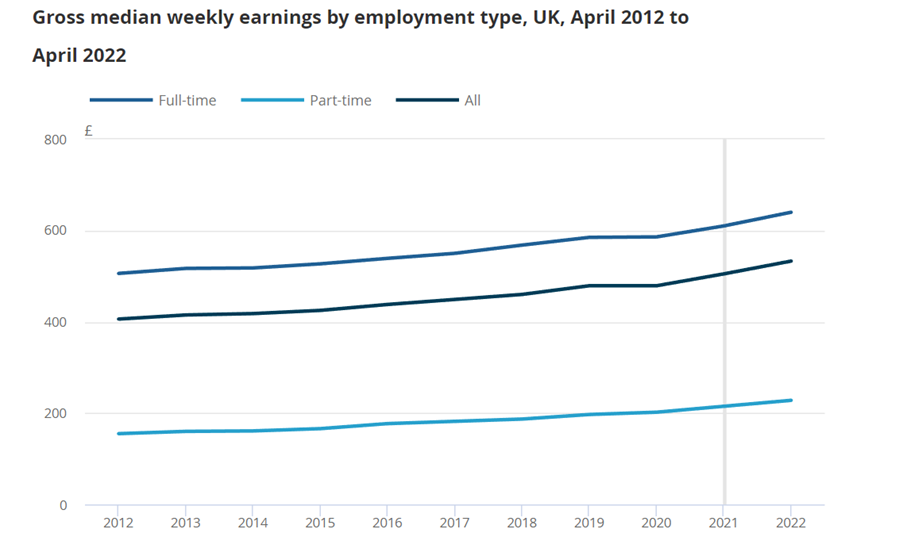

On the other hand, UK wages have not seen such a sharp increase. The below graph shows the average weekly earnings of UK earners between 2012 and 2022.

Source: ONS

Comparing the two, while in December 2012 the average house price stood at £168,843, the average house price in December 2022 was £294,329 – an approximate 170% increase.

Whereas the average full-time weekly wage in 2012 was £506, and had only increased to £640 in 2022 – an approximate 25% increase over a full decade.

All this to say, buying a first home may not be possible for your adult children, even if they are diligent savers.

So, if they approach you for support, it may be wise to listen to their concerns and consider the following steps if possible.

2 effective ways parents and grandparents can help first-time buyers

1. Provide funds for a deposit

One major challenge first-time buyers face is saving enough to make a substantial downpayment. If you have funds set aside to help boost their home savings, now might be a great time to step in.

If you don’t already have wealth ringfenced for this purpose, it is essential to ensure you can afford to provide the amount they need. Handing over money without expert advice could lead you to:

- Deplete your retirement savings too quickly

- Struggle financially during the cost of living crisis

- Crystallise investments at a loss

- Lose financial stability later in life.

Fortunately, the advice of a mortgage broker can help you assess how much your loved ones might need for the home they want, and help you assess your own affordability before you proceed.

For example, there may be methods where you can provide help towards a deposit without losing control of those funds in the long term, such as by using a “family mortgage”.

2. Sign on as a mortgage guarantor

Alternatively, you can sign on as a guarantor for your loved one’s mortgage.

Here, your role assures a lender that if the homeowner (your child) is unable to make repayments, you are responsible for footing the bill.

So, it is crucial to assess your child’s financial responsibility, and discuss this move with them extensively, before signing on as a guarantor. You will be legally responsible for the entire debt if your child can’t pay, so it is important to have a frank conversation before signing on.

If you are confident your child can pay their mortgage, being their guarantor might help them find an affordable mortgage deal this year.

Again, it could be wise to work with a broker before agreeing to act as a guarantor. We can help you understand both the benefits and the risks of this venture.

Get in touch

To discuss helping a first-time buyer onto the ladder with a seasoned expert, email enquiry@edinburghmortgageadvice.co.uk or call 0131 339 2281 to speak to us.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.

Think carefully before securing other debts against your home.