Over the past few years, the Covid-19 pandemic and the cost of living crisis have created uncertainty across the financial sector. One of the sectors that has rarely been out of the news is the housing market.

According to the UK House Price Index, house prices across the UK have been steadily growing for more than a decade year-on-year. The latest annual growth data confirms the average UK house price increased by 12.6% in the year to October 2022.

Even though it’s impossible to fully predict what will happen to house prices over the next 12 months, it seems as though they began to fall during the final months of 2022.

If you’re a first-time buyer or you’re looking to sell your home this year, you might be wondering how the recent fall in house prices might affect your plans – and what might happen if they continue on this trajectory.

Read on to learn what experts predict could happen to UK house prices in 2023, and what these shifts could mean for you.

House prices are predicted to decline throughout 2023

As 2022 drew to a close, month-on-month house prices began to decrease, while year-on-year figures mostly reported a slow in house price growth overall.

Interestingly, a Forbes report reveals Scotland has experienced a steep slow in house price growth in the year to December 2022, compared with the previous month. Scottish house prices grew by 3.5% between December 2021 and December 2022, compared to 6.4% in the year to November 2022.

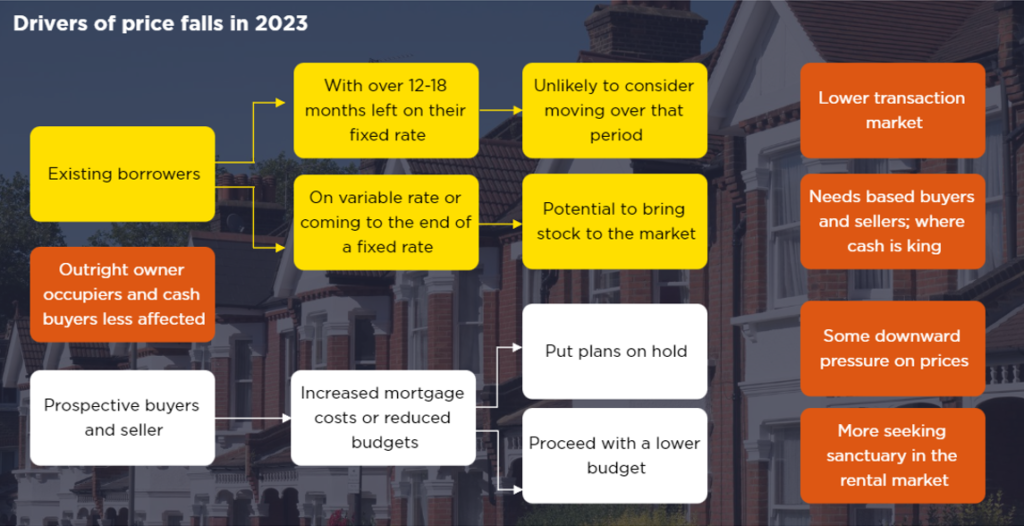

Indeed, the report found the average UK house price fell by 2.4% and 1.5% in November and December respectively. On this, Halifax Mortgages director Kim Kinnaird states, “We expect there will be a reduction in supply and demand overall”, while “buyers and sellers remain cautious” following the market turmoil of 2022. As a result, Kinnaird predicts house prices will “fall by 8% over the course of the year”. In another prediction of a decline, Savills predicts nominal house prices will fall by around 15% across 2023. In November 2022, Savills produced the below graphic explaining the factors they believe will cause prices to decline.

Source: Savills

In addition, the Guardian forecasts house prices could decrease between 5% and 12% in 2023, before increasing year-on-year until 2026.

If you’re searching for a home in 2023, you could be placed in a favourable position

Fortunately, if house price growth slows, or even enters negative growth in 2023, it could be easier to find the home you want.

Interestingly, Reuters reported that enquiries for rental properties jumped in October 2022, which suggests that buyers were put off from proceeding with their plans at the end of the year.

However, it’s important not to panic – this doesn’t necessarily need to be the case if you are hoping to buy a home soon. If house prices continue to fall this year, you could find your dream home is more affordable than in previous years.

When selling your home in 2023, you may need to prepare for a decline in prices

Even though the news of falling house prices can be helpful for homebuyers, if you’re thinking of selling your home in the next 12 months, the news might not be quite what you were hoping for.

If the drop in house prices continues, you may find that the price you can sell your home for is lower than you had hoped. This means that if you are relying on income from a home sale, it is important to prepare for a slow in house price growth. This is particularly noticeable after the market’s increases in recent years.

It is possible that some areas of the UK will experience a more significant reduction in house prices than others, or that the drop in prices will last for longer than in other areas. For example, the BBC has reported that, following the 2008 financial crash, house prices in the north-east of England only returned to their pre-crash levels in 2020.

So, the truth is, your individual circumstances are much more important than the UK averages that will be reported in the news.

Working with a mortgage broker when buying or selling your home can help you understand the options available to you.

If you need a mortgage in 2023, rates could lower after a spike at the end of 2022

Arguably the most controversial financial event of last year, Kwasi Kwarteng’s mini-Budget had widespread effects across the UK financial sector. One of the most significant outcomes for first-time buyers was the announcement’s impact on mortgages.

The Guardian reports that the market volatility caused by the mini-Budget led to a 10% reduction in the number of mortgage approvals in October. What’s more, according to the Evening Standard five-year fixed mortgage rates soared to 6% for the first time since 2010.

If you’re looking for a mortgage this year, it’s important to keep pace with changes to the market. Already, as 2023 begins, many lenders have reduced their rates – and this trajectory may continue throughout the year.

You can read our full insights on how the mortgage market could perform in 2023 on our blog page.

Working with an expert can help you buy, sell and market your home in any environment

Whether you are hoping to buy your first home or are selling your existing home to move somewhere different, working with an independent mortgage broker could be very helpful.

An experienced broker can help you access a wealth of knowledge and experience about buying, selling, and marketing a home even in the most difficult of circumstances.

Your broker will be able to help you stay up to date with any changes to mortgage rates that will affect you. Recently, changes have sometimes been happening on an almost daily basis, so having the support of an expert to help you decipher those changes could be invaluable.

If you are looking for a mortgage, your broker will be able to connect you with experienced lenders who may have the right product for you. They understand that there is no such thing as a one-size-fits-all mortgage product, so having those existing relationships with lenders could mean you can find what you’re looking for without incurring additional financial or emotional stress.

More than anything though, a broker can give you the support and peace of mind that could allow you to achieve whatever outcome you are most hoping for.

Get in touch

If you’d like to learn more about how we can help you to buy or sell your home, we’d be delighted to help. Email enquiry@edinburghmortgageadvice.co.uk or call 0131 339 2281 to speak to us.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.

Think carefully before securing other debts against your home.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

acheter kamagra au canada

prescription kamagra livraison

how to order enclomiphene cheap online canada

get enclomiphene uk cheap purchase buy

get androxal using mastercard

androxal american express canada

is there anything over the counter like flexeril cyclobenzaprine

buy cheap flexeril cyclobenzaprine cheap canada pharmacy

how to buy dutasteride australia buy online

buy dutasteride cheap buy online no prescription

cheapest buy gabapentin usa drugstore

online order gabapentin purchase no prescription

buy fildena cheap united states

order fildena prescription

online order itraconazole real price

buy itraconazole singapore where to buy

Next day fedex shipping for staxyn

discount staxyn generic online cheapest

cheapest buy avodart buy dallas

get avodart canada shipping

buy generic xifaxan from canada

purchase xifaxan generic next day delivery

how to buy rifaximin generic pharmacy usa

how to buy rifaximin generic mastercard

nákup kamagra bez lékařského předpisu

levné kamagra bez lékařského předpisu další den doručení

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.