If you are a homeowner, your monthly mortgage payments may have increased in the last few months. Or, perhaps your fixed-rate deal is coming to an end and you’re concerned about what your repayments will be at that time?

Similarly, if you are a planning on buying a house, you need to know how best to minimise the impact that rising interest rates and mortgage repayments will have when taking your first or next steps on the property ladder.

Due to the uncertainty over the UK economy and rising inflation, sat at 10.1% as of March 2023, it is now more important than ever to shop around and find the most suitable way of reducing your monthly mortgage repayments. One of the ways that could help you achieve this is an offset mortgage.

But what exactly is an offset mortgage, and would it be the best option for you? Read on to find out.

An offset mortgage is a type of mortgage that’s linked to your savings account

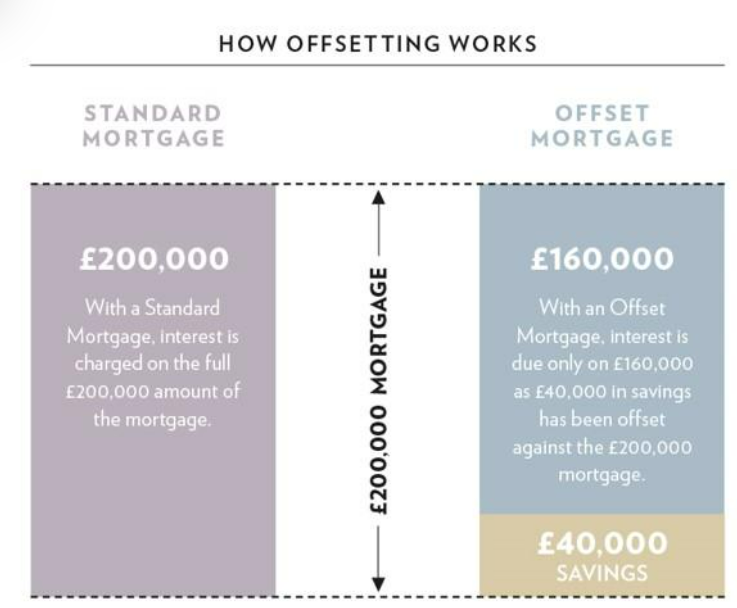

When you choose an offset mortgage, you can link your bank and savings accounts to your mortgage. Any money in your linked savings accounts will lower the total interest you will be charged – hence “offsetting” your mortgage balance.

Essentially, the offset mortgage treats the amount of savings you have as if it was “credit” on your mortgage – as the graphic below shows.

Source: Family Building Society

Why an offset mortgage might work for you

If you have cash saved for a rainy day or a purchase that won’t be required soon, an offset mortgage could be ideal. The surplus funds could be used to reduce the interest you pay on your mortgage.

Using the example from the graphic above, if you have a typical £200,000, 30-year capital and interest mortgage at a rate of 2.19%, your monthly mortgage repayments would be £758.39 each month.

However, if you have an offset mortgage and £40,000 in your linked savings account, your monthly mortgage repayments would be £73 cheaper, at £685.39 each month.

Alternatively, you could choose to keep your monthly mortgage repayments at £758.39. Using the example above, you would finish repaying your mortgage four years earlier using this strategy.

What you need to consider

If you’re thinking about choosing an offset mortgage, one possible downside is that you may pay a higher interest rate. Offset mortgages often have higher initial rates than their alternatives, meaning your standard monthly repayments might not be as low as a more traditional option.

Alongside that, it’s unlikely that you will earn interest on the savings in your linked account. The money will be used to reduce the interest charged on your mortgage, so unlike with a Cash ISA or a traditional savings account, you won’t see these savings grow.

Get in touch

As with any house buying or remortgaging decision, it’s always a good idea to speak with us before you act. We can help you investigate the best options available to you and choose the most suitable mortgage for your circumstances.

Email enquiry@edinburghmortgageadvice.co.uk or call 0131 339 2281 to speak to us.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.