When you are applying for a mortgage, there are so many eligibility factors that can work both against you and in your favour.

Continue reading

When you are applying for a mortgage, there are so many eligibility factors that can work both against you and in your favour.

Continue reading

Are you planning to buy a home but don’t know where to start with the mortgage process? Consider using a mortgage adviser to help you navigate the complex world of home loans. Here are some of the top benefits of working with a mortgage adviser:

One of the most significant benefits of using a mortgage adviser is access to a wide variety of lenders. Instead of having to shop around and compare rates from multiple lenders yourself, a mortgage adviser can do the legwork for you. They have relationships with many different lenders and can help you find the best loan options based on your unique financial situation.

Mortgage advisers are experts in the field of home loans. They have a deep understanding of the market, different loan products, and can offer guidance on which loan option would be best for you. advisers can also help you understand the different fees and charges associated with each loan option, so you can make an informed decision.

Each borrower is unique, and a mortgage adviser can help you find a loan that is tailored to your specific needs. Advisers can consider factors like your credit score, income, and the amount you can put down on a home to find loan options that work for you.

Working with a mortgage adviser can save you both time and money. Advisers can shop around and compare rates and terms from multiple lenders on your behalf, which can save you time and money in the long run. Plus, advisers may be able to negotiate better rates or waive certain fees, which can save you even more money.

When you work with a mortgage adviser, you get personalized service. Advisers will work closely with you to understand your unique financial situation and goals, and they can help guide you through the entire mortgage process. If you have any questions or concerns, your adviser is just a phone call or email away.

In conclusion, working with a mortgage adviser can be incredibly beneficial when it comes to buying a home. Advisers offer access to multiple lenders, expertise and guidance, customized loan options, time and money savings, and personalized service. If you’re in the market for a home loan, consider partnering with a mortgage adviser to help you find the best loan options and navigate the process with ease.

Now if you would like to chat to one of our avisers then please click here to book an initial chat

The new year represents something different for every individual – but around the world, setting goals and reflecting on our personal journey is a universal act at this time of year.

Kindness is an action that many of us wish we could prioritise more, but in the busy, often individualistic lives we lead, sometimes it could feel like there just isn’t enough room to help others.

Indeed, you couldn’t be blamed for often being focused on optimisation – working smarter, increasing your productivity, earning more money, eating more healthily, or becoming fitter, to name a few examples – but often, this growth mindset can become ego-driven.

Read on to find out how prioritising kindness can not only benefit others, but can also help you become a more productive, happier person overall.

Scientists believe that practising compassion for others can create tangible changes in your own life

The act of practising kindness might seem unfamiliar to many of us. Indeed, you might consider kindness as something that comes naturally in the moment, rather than an active project you work on as part of your personal growth.

But according to Dartmouth University, kindness is not only teachable and contagious, but it has tangible health benefits for those who consciously prioritise it.

According to the research, being kind can:

If you apply the results of this research to your own life, you could find that engraining kindness into your daily routine could improve your mood, health, and overall quality of life.

Kindness can build resilience and reduce anxiety, according to spiritual leaders

Not only does the science tell us that kindness can radically improve your life, but spiritual leaders also swear by the incredible healing power of compassion.

In a report published by Fast Company, meditation expert Vishen Lakhiani, author of The 6 Phase Meditation Method, claims that “[Kindness] reduces your perceived threats. For example, if someone cuts you off on the highway, you don’t think of them being a jerk. You think, ‘Hmm, I wonder what they’re rushing for’”.

Lakhiani goes on to encourage readers to begin practising kindness at home with your spouse, children, and extended family. Then, continue to bring this daily action into your wider life, and observe how it makes you feel – not just about those people, but about yourself and the world at large.

We could all do with a little more kindness in our lives, both towards ourselves and to others.

So, take the advice of the scientists and spiritual healers who have incorporated kindness into every area of their lives, and see how compassion could change your life in 2023 and beyond.

If you have been searching for a mortgage deal for a few months, you will know that the market took a somewhat unfavourable turn in the final months of 2022.

Indeed, many lenders had been raising rates steadily over the course of the year, in line with the Bank of England’s (BoE) continuous increasing of the base rate, which now stands at 3.5%.

Then, in September, the former chancellor’s bold mini-Budget proved a further hinderance to the mortgage market. The Guardian reports more than 40% of the market “disappeared almost overnight” as lenders began withdrawing deals. Plus, two-year fixed-rate deals surpassed 6% for the first time since 2008, Bloomberg reports.

As we begin 2023, you could be wondering: “what will happen to mortgage rates this year?”

Read on to find out expert predictions for the mortgage market in 2023.

Experts predict mortgage rates could steadily decline from the highs they reached in 2022

Since reaching their peak in October 2022, many lenders have eased their rates – although these may still seem high when compared with the historic lows introduced during the Covid-19 pandemic.

Moneyfacts data reveals that, as of 13 January 2023, the lowest two-year fixed-rate mortgage deal on the market for someone moving home stands at 4.65%. For first-time buyers, the lowest rate available is 4.82%.

In light of the deflation of rates since October, many experts predict they will continue to slowly decline over the course of 2023. If the BoE continues to raise the base rate by multiple percentage points, rates could rise again – but if the base rates peaks at its current level, lenders may maintain the mortgage deals currently on offer, or even offer cheaper products.

It is important to note that, according to FTAdviser, the recent interest rate rises have caused mortgage approvals to drop to their lowest level since before the 2020 lockdowns. So, lenders could begin reducing their rates to tempt borrowers back into the market.

However, there is no crystal ball when it comes to mortgages. Trying to time the market can lead to disappointment – so working with a mortgage expert as you search for a new home could be the most constructive move.

House prices are predicted to fall in 2023, meaning you may need to borrow less

Of course, when looking for a new mortgage, the price of the home you wish to buy is a huge contributing factor.

A survey of economists conducted by the Times predicts that house prices could experience “double digit declines” in the coming months. Indeed, while house prices are still rising year-on-year, since October 2022 the average month-on-month price has begun to decline. In December 2022, Halifax posted the steepest house price decline in 14 years, the Guardian reports.

You can read our full insights on how house prices could perform in 2023 on our blog page.

The bottom line is: if your dream home decreases in value, you may need to borrow less. So, although mortgage rates are unlikely to return to the lows they reached during the pandemic, you could still find an affordable deal this year.

Get in touch

Working with a mortgage expert can put your mind at ease in turbulent times. For a discussion about finding an affordable mortgage, selling your current home, or any other property matter, email enquiry@edinburghmortgageadvice.co.uk or call 0131 339 2281 to speak to us.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. Buy-to-let (pure) and commercial mortgages are not regulated by the FCA. Think carefully before securing other debts against your home.

Over the past few years, the Covid-19 pandemic and the cost of living crisis have created uncertainty across the financial sector. One of the sectors that has rarely been out of the news is the housing market.

According to the UK House Price Index, house prices across the UK have been steadily growing for more than a decade year-on-year. The latest annual growth data confirms the average UK house price increased by 12.6% in the year to October 2022.

Even though it’s impossible to fully predict what will happen to house prices over the next 12 months, it seems as though they began to fall during the final months of 2022.

If you’re a first-time buyer or you’re looking to sell your home this year, you might be wondering how the recent fall in house prices might affect your plans – and what might happen if they continue on this trajectory.

Read on to learn what experts predict could happen to UK house prices in 2023, and what these shifts could mean for you.

House prices are predicted to decline throughout 2023

As 2022 drew to a close, month-on-month house prices began to decrease, while year-on-year figures mostly reported a slow in house price growth overall.

Interestingly, a Forbes report reveals Scotland has experienced a steep slow in house price growth in the year to December 2022, compared with the previous month. Scottish house prices grew by 3.5% between December 2021 and December 2022, compared to 6.4% in the year to November 2022.

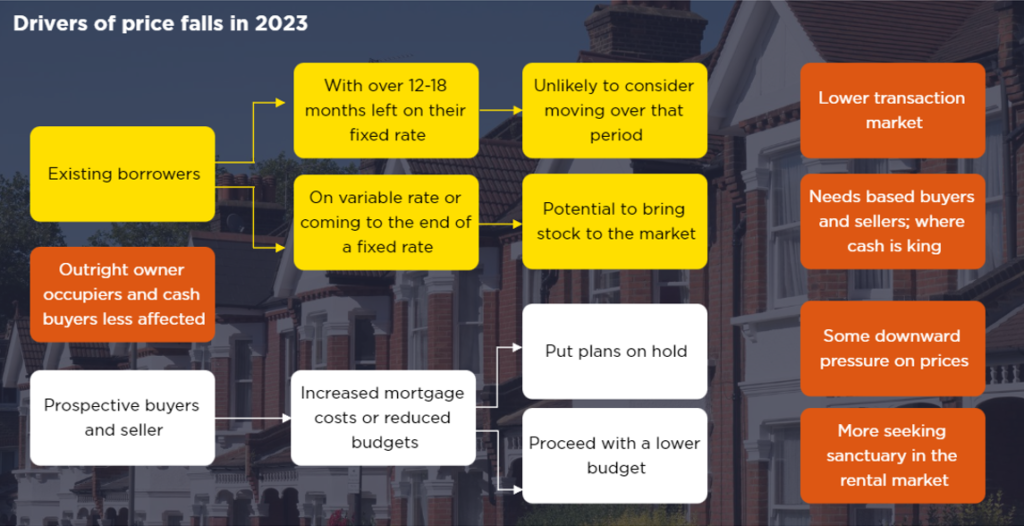

Indeed, the report found the average UK house price fell by 2.4% and 1.5% in November and December respectively. On this, Halifax Mortgages director Kim Kinnaird states, “We expect there will be a reduction in supply and demand overall”, while “buyers and sellers remain cautious” following the market turmoil of 2022. As a result, Kinnaird predicts house prices will “fall by 8% over the course of the year”. In another prediction of a decline, Savills predicts nominal house prices will fall by around 15% across 2023. In November 2022, Savills produced the below graphic explaining the factors they believe will cause prices to decline.

Source: Savills

In addition, the Guardian forecasts house prices could decrease between 5% and 12% in 2023, before increasing year-on-year until 2026.

If you’re searching for a home in 2023, you could be placed in a favourable position

Fortunately, if house price growth slows, or even enters negative growth in 2023, it could be easier to find the home you want.

Interestingly, Reuters reported that enquiries for rental properties jumped in October 2022, which suggests that buyers were put off from proceeding with their plans at the end of the year.

However, it’s important not to panic – this doesn’t necessarily need to be the case if you are hoping to buy a home soon. If house prices continue to fall this year, you could find your dream home is more affordable than in previous years.

When selling your home in 2023, you may need to prepare for a decline in prices

Even though the news of falling house prices can be helpful for homebuyers, if you’re thinking of selling your home in the next 12 months, the news might not be quite what you were hoping for.

If the drop in house prices continues, you may find that the price you can sell your home for is lower than you had hoped. This means that if you are relying on income from a home sale, it is important to prepare for a slow in house price growth. This is particularly noticeable after the market’s increases in recent years.

It is possible that some areas of the UK will experience a more significant reduction in house prices than others, or that the drop in prices will last for longer than in other areas. For example, the BBC has reported that, following the 2008 financial crash, house prices in the north-east of England only returned to their pre-crash levels in 2020.

So, the truth is, your individual circumstances are much more important than the UK averages that will be reported in the news.

Working with a mortgage broker when buying or selling your home can help you understand the options available to you.

If you need a mortgage in 2023, rates could lower after a spike at the end of 2022

Arguably the most controversial financial event of last year, Kwasi Kwarteng’s mini-Budget had widespread effects across the UK financial sector. One of the most significant outcomes for first-time buyers was the announcement’s impact on mortgages.

The Guardian reports that the market volatility caused by the mini-Budget led to a 10% reduction in the number of mortgage approvals in October. What’s more, according to the Evening Standard five-year fixed mortgage rates soared to 6% for the first time since 2010.

If you’re looking for a mortgage this year, it’s important to keep pace with changes to the market. Already, as 2023 begins, many lenders have reduced their rates – and this trajectory may continue throughout the year.

You can read our full insights on how the mortgage market could perform in 2023 on our blog page.

Working with an expert can help you buy, sell and market your home in any environment

Whether you are hoping to buy your first home or are selling your existing home to move somewhere different, working with an independent mortgage broker could be very helpful.

An experienced broker can help you access a wealth of knowledge and experience about buying, selling, and marketing a home even in the most difficult of circumstances.

Your broker will be able to help you stay up to date with any changes to mortgage rates that will affect you. Recently, changes have sometimes been happening on an almost daily basis, so having the support of an expert to help you decipher those changes could be invaluable.

If you are looking for a mortgage, your broker will be able to connect you with experienced lenders who may have the right product for you. They understand that there is no such thing as a one-size-fits-all mortgage product, so having those existing relationships with lenders could mean you can find what you’re looking for without incurring additional financial or emotional stress.

More than anything though, a broker can give you the support and peace of mind that could allow you to achieve whatever outcome you are most hoping for.

Get in touch

If you’d like to learn more about how we can help you to buy or sell your home, we’d be delighted to help. Email enquiry@edinburghmortgageadvice.co.uk or call 0131 339 2281 to speak to us.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.

Think carefully before securing other debts against your home.

There has been lots of talk about the new Government Schemes helping people get on the ladder.

But what about the people who are already on the ladder? Well we have a lender that can help people remortgage up to 95% using the same scheme even if that involves clearing some existing debt.

So if you have been told by your bank that you don’t have enough equity, why not give us a call and let us sort out your 95% remortgage?

Here are the facts about Help to Buy written in plain English to help you understand whether either of these finance schemes are right for you.

Who is Help to Buy aimed at?

Help to buy is aimed at those who want to get on the property ladder and can afford to pay a mortgage – but don’t have a big deposit payment.

What is the minimum deposit payment?

In order to qualify for any of the Help to Buy options (or indeed any mortgage) you must have a deposit of at least 5% of the value of the property you want to buy.

Is it only available to 1st time buyers?

No, anyone can apply for either Help to Buy scheme.

How does Help to Buy work?

There are two different versions of the scheme, here are the main differences:

| Scheme |

Help to Buy 1 |

Help to Buy 2 |

| What is it? | A shared equity scheme, this means that the Government will loan you up to 20% of the value of the property. | A mortgage guarantee scheme, this means the Government will act as a ‘guarantor’ for up to 15% on a standard mortgage should you default on your payments |

| Can I use it to buy any property | No only new properties | Yes this is available on old and new properties |

| Minimum deposit | 5% | 5% |

| Maximum house value | £600,000 in England£400,000 in Scotland | £600,000 |

| Main impact | When you come to sell the property you must give the Government 20% of the sale price. This means you get 80% of the profits instead of 100%. | Stricter affordability criteria and potentially slightly higher interest rates (as the lender must pay the government a fee for the guarantee). |

| Can I use it to buy a ‘Buy to Let’ property? | No | No |

| Examples: | House valued at £200k financed as follows:

|

House valued at £200k financed as follows:

|

| Additional Costs | None for the first 5 years.If you live anywhere in the UK except Scotland then you must pay an annual fee of 1.75% of the loan which rises annually by RPI + 1%. (This does not apply in Scotland) | No |

What are the advantages and disadvantages?

|

Advantages |

Disadvantages |

|

|

Are there any other finance schemes which help people with a small deposit buy a house?

YES! There are a number of other options such as LIFT and New Buy, their suitability depends on your circumstances and where you live etc. Please also remember that there are lenders out there willing to offer 95% mortgages with competitive rates to borrowers with good credit scores.

No matter what your circumstances are, talk to us if you would like help to find the best mortgage in the whole market AND sound advice on whether there are any of the home buying finance schemes are suitable for you.

Here is an article from the Times about Help to Buy 2 (the new Government back mortgage guarantee scheme). It essentially works as the HM Gov acting as a guarantor (in a limited capacity) for clients.

Edinburgh Mortgage Advice in the Times 29/11/2013

If you want to chat over any of the schemes to help clients with smaller deposits such as Help to Buy (shared equity – New Build Only) LIFT (Scotland only) or the New Help to Buy 2 scheme, then please give us a call on 0131 339 2281

Today, the Times has an article about the latest movements on rates in the mortgage market. Here we are adding our two-penneth

http://www.thetimes.co.uk/tto/life/property/prices-investment/article3831370.ece (£)

In essence what we say is that interest rates are so low that lenders are having to innovate to hit headlines and catch market share and with news today that HSBC have launched a 2 year fix at 1.49% this seems likely to continue.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE OR OTHER LOANS SECURED ON IT

Any fee payable for our services will depend upon your circumstances. In these situations we will inform you during our initial discussions and detail it in the Our Service to You document. In these cases our usual fee is £395 (for Buy to Let mortgages it is £495).

Edinburgh Mortgage and Thistle Finance are trading styles of Mark Dyason who is authorised and regulated by the Financial Conduct Authority, and is entered on the FCA register (https://www.fca.org.uk/firms/financial-services-register) under reference 607668.

Why Nationwide’s large increase in profit is good news

Here is an article from the Daily Mail saying about Nationwide’s recent increase in profits and lending and Mark’s comments about why this is good news.

http://www.dailymail.co.uk/money/markets/article-2507789/Nationwide-takes-fight-banks-profits-leap-155-mortgage-lending-soars-nearly-4billion-just-months.html