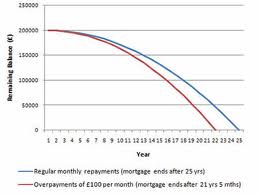

This is the first in a set of posts to highlight mortgage features that you could make use of:-

- Overpayments drive down the total amount and term you pay

1. Over-payments – most mortgage providers will allow you to overpay either monthly or by lump sum into your loan with no penalty, even if you are currently within your tie in period.

The limit for these is usually either 10% of the outstanding loan per year or a set amount per month e.g. Nationwide allow £500 per month, Halifax 10% of the balance per year. Check with your lender about their limit.

Some of the uses of overpaying can be to increase your equity following a downturn in value, repay fees added at the start or shorten the overall term of the loan. All 3 of these leave you in a stronger position when you next need to do something with your loan.

For people on Interest Only this can be a useful tool to start to pay down the mortgage especially if you do not/cannot make the commitment to full repayment at this point. Don’t let the problem build, my advice would be a full review, however consider overpayments as a way to tackle it at a rate you can afford via over-payments.

And remember that most lenders LOVE the fact they are getting their money back, however be aware that if it turns out you need the money back at some point then you will have to go through the further advance process, or book some ‘holiday’ months from your mortgage, if you lender offers this. Mortgage Over-payment is great, but don’t over-stretch yourself.

We have just added a Mortgage over-payment calculator to the site meaning you can now see what effect a small monthly addition to your mortgage can make.

Before clicking the link I want you to imagine how much extra you would need to pay monthly to clear your mortgage 3 years early.

Now go find out, it might be less than you think and remember if this is still not clear, why not give us a call on 0131 339 2281 and chat for free to a mortgage advisor.